-

-

Operating a Franchise (Federal Trade Commission Consumer Information)

When you buy a franchise, you get to operate a business and sell goods or services with name recognition. You buy a format or system developed by the franchisor, and training and support. But investing in a franchise, like all investments, involves financial risk. Franchisees must commit money and time, and must operate by the franchisor's playbook.

-

Mastering Cash Inflows and Outflows

In a recent business seminar hosted by Mission Valley Bank, bank consultant Robert Dyck cited a statistic that 70% of businesses – large, mid, and small – fail due to cash flow problems. With three main sources of cash flow activity – operating, investing, and financing – he stressed how vital it is to understand and monitor cash flow in your business.

Michael Dell, founder of Dell Technologies, summed up his company’s lack of attention to cash inflows and outflows with an analogy. “We were always focused on our profit and loss statement. But, cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”

-

IT’S ALL ABOUT BUILDING RELATIONSHIPS

It’s all about building relationships. Recently, Mission Valley Bank’s Vice President and Business Banking Officer Paula Bahamon participated in a Women’s Collaborative Colloquium at CSU, Northridge with the purpose of elevating women business owners. Here is what the hosting organization, Women’s Collaborative Mentoring Program (WCMP), said about Paula --

“Paula Bahamon is an exceptional banker who understands how to support Women in Business. Last October, the WCMP held a Women’s Collaborative Colloquium at CSU, Northridge with the purpose to elevate women business owners. The Colloquium began with a leadership/mentoring award followed by industry expert panels and concluded with a speed mentoring (matchmaking).

-

Safeguarding Your Information for You & Your Business

Did you know, community banks adhere to rigorous laws, regulations, guidance, and voluntary frameworks to safeguard client information, according to the Independent Community Bankers Association. In a statement for a Small Business Committee hearing on small-business cybersecurity, ICBA said Congress and the federal banking agencies should recognize community banks’ flexible approach to cybersecurity and preserve this approach in any new laws or regulations.

The U.S. Department of Homeland Security warns to never give sensitive information to anyone unless you are sure they are, who they claim to be and that they should have access to the information. It’s every business owner’s worst fear that they could be the next target.

-

Managing the Financial Health of Business

Most independent business owners are challenged by having to play multiple roles with limited time. They put on – and take off – many management hats, often wearing them simultaneously. But the one that can never be shed is that of Financial Manager and Planner. With the responsibility of managing your company’s finances comes the requirement to understand them.

When viewed together, the balance sheet and income statement represent a complete and, hopefully, accurate financial picture of the company. Unfortunately, some businesses produce two or three sets of financial statements – one for the IRS, one for the banker, and one for themselves. Whatever the reasoning, it is important to remember that the worst possible person to kid is yourself. Every business owner needs clear, concise, decision-relevant information.

-

CELL PHONES & THE DO NOT CALL REGISTRY

The Federal Trade Commission strongly urges consumers to place their cell phone numbers on the National DO NOT CALL Registry to notify marketers that they don't want to get unsolicited telemarketing calls. Despite viral email, there is no new cell phone database.

The truth about cell phones and the Do Not Call Registry is:

-

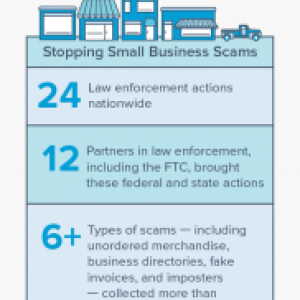

SCAM ALERT from the FEDERAL TRADE COMMISSION

According to Colleen Tressler, Consumer Education Specialist with the FTC, they’re at it again...tax scammers scheming new ways to steal personal information and money.

In the first scenario, identity thieves file a fake tax return and have the refund deposited into your bank account. The thieves then contact you, often by phone, and — posing as the IRS or debt collectors for the IRS — demand you return the money to the IRS. But following the thieves’ instructions actually sends the money to them.

In another version, after you get that erroneous refund, you get an automated call, allegedly from the IRS, threatening you with criminal fraud charges, an arrest warrant, and “blacklisting” of your Social Security number. The caller gives you a case number and a telephone number to call to return the refund.

-

Take Control with Online & Mobile Banking

Ever wonder how you can keep better track of your spending? Save money more easily? Bank more efficiently? Eliminate late-fee charges on your bills? Even help protect yourself from fraud? The solution for much of these is already right in your hands — Online and Mobile Banking.

These services give you the power to connect with your money anytime, anywhere, and offer tools and features to help you control your money more easily than ever before. You can: